Introduction of SPACs and the Advent of SPACs in Singapore

Will Special Purpose Acquisition Companies (SPAC) in Singapore be able to capture some of the momentum that U.S SPACs have experienced? On September 3rd, 2021, the Singapore Exchange (SGX) launched new rules allowing for Special Purpose Acquisition Companies to list. Private companies can be acquired by a SPAC, allowing them to reach public markets in a quicker fashion than going through an IPO or a Direct Listing. With an ever-increasing number of companies going public through SPACs in the U.S, the SGX hopes to bring the same wave to Asia.

Figure 1: How do SPACs Work? (From CB Insights)

Before we start, let’s talk about what a SPAC is. A SPAC is a “blank check company” or a “shell company” whose sole purpose is to acquire private company to bring the company public. In Figure 1 we can see a helpful infographic from CB Insights which outlines the lifecycle of a successful SPAC. In steps 1-4 of the infographic, we can observe the initial issuance of SPAC. Investors can take part in the Initial Public Offering (IPO) if the SPAC and are able to purchase warrants and shares of the SPAC.

In steps 5-6, the sponsor or the manager of the SPAC must find a target company to acquire. Often SPACs acquire companies in certain sectors, which are predetermined before the creation of the SPAC. This allows investors to understand what company the SPAC may intend to merge with allowing them to make a more informed decision whether to participate.

The process of predefine which sector a SPAC will transact in also helps with the shareholder approval process which is done in step 7. Once a SPAC finds a takeover target and terms are agreed with between the sponsor and the target company, the deal is brought over to shareholders and board members of the SPAC. Terms of the deal must be attractive enough for the stakeholders to approve. In the event that any of the two stakeholders do not approve, merger fails, the target company fails to go public, and the sponsor must return the money raised from investors during its IPO back to investors with interest.

If shareholder and board member approval is reached, the SPAC can proceed. This is called the de-SPAC process, which is shown in steps 8 and 9. During the de-SPAC process, the target company can raise additional money through external funding through vehicles such as a PIPE (private investment in public equity), debt issuance, or addition equity issuance to the public. Finally, the SPAC acquires the target company, and the target company is now able to be traded publicly.

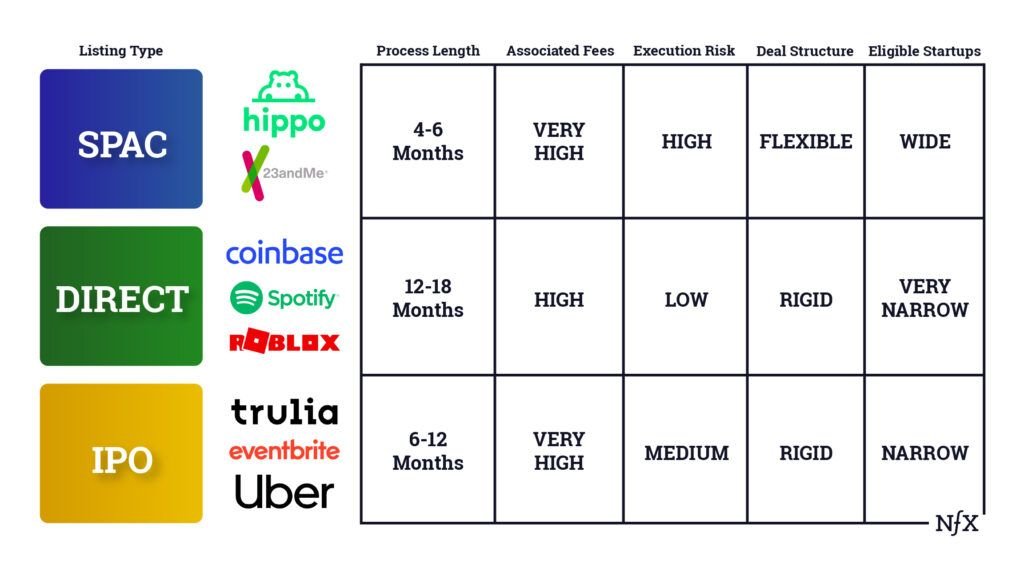

Figure 2: Comparison of Public Listing Methods (From NfX)

Like all other financial instruments, SPACs are a tool. A smart investor or an institution will use the right tool to achieve their goal. SPACs are much faster way to bring a company public then its peers. Deal structure can be customized, and importantly, companies can easily raise money through external investment, debt insurance, or additional assurance of equity during the de-SPAC process. The ability to raise additional external funding while going public requires far less complexity compared to its alternatives.

As shown in Figure 2, SPACs come along with their fair share of risks. Sponsors of the SPACs often receive around 20% of the SPAC’s shares for free as an incentive to find desirable private company to merge with. Often sponsors receive additional benefits in the form of board seats or warrants for successfully taking a company public. Execution risk is also high. A target company will be unable to go public in the event that a SPAC’s shareholders and board members disapprove of the merger. This could potentially be disastrous for a company seeking imminent liquidity. Sponsors will also be uncompensated for any costs incurred during the target company searching process including management fees. In the event of a failed de-SPAC, sponsors will have to return money received during the initial IPO process in addition to interest.

Table 1: Singapore Exchange SPAC Rules (SGX News Releases, SGX introduces SPAC listing framework, 2 Sep 2021)

Table 1 lists some of the requirements of SPACs on the Singapore Exchange (SGX). By having similar rules to SPAC listings in the U.S, the SGX hopes to bring international investors to its marketplace and makes itself an attractive alternative to U.S markets. We can expect to see an increasing number of Asian companies to on the SGX closer to home, rather than in the U.S. We can also expect companies to choose going public through a SPAC on the SGX over a more arduous Hong Kong IPO. Additionally, companies that do not have the scale or required history to go public through IPO or Direct Listing may the opportunity to go public through SPACs.

The attractiveness of SPACs in Singapore has already started to show. Grab and Property Guru expect to be going public through a SPAC later this year. Grab is going public through a SPAC based in Menlo Park, California, Altimeter Growth Corp, at $40B valuation. Property Guru is going public through Bridge Town 2 holdings with under the guidance of renowned investors Richard Li and Peter Thiel at a $1.8B valuation. We should expect more unicorns to list on the SGX in the near future.

With the advent of Singaporean SPACs, the SPAC market is expected to heat up in Asia. Hong Kong and Taiwan are looking to introduce SPACs on their respective exchanges. Expect to see more innovation in the financial engineering of companies going public in Asia. If all goes well, we will be able to see a wave of companies going public like we are in the U.S.